Prefabricated Open-Web Wood Floor Trusses in Your Future?

Use of open-web floor trusses has steadily increased over this past decade, but there’s a lot of room to grow. Ed Huston from Home Innovation Research Labs (HIRL) recently shared some results from their April 2021 Builder Best Practice Reports on Structural Systems, containing survey results from over 1500 homebuilder participants.

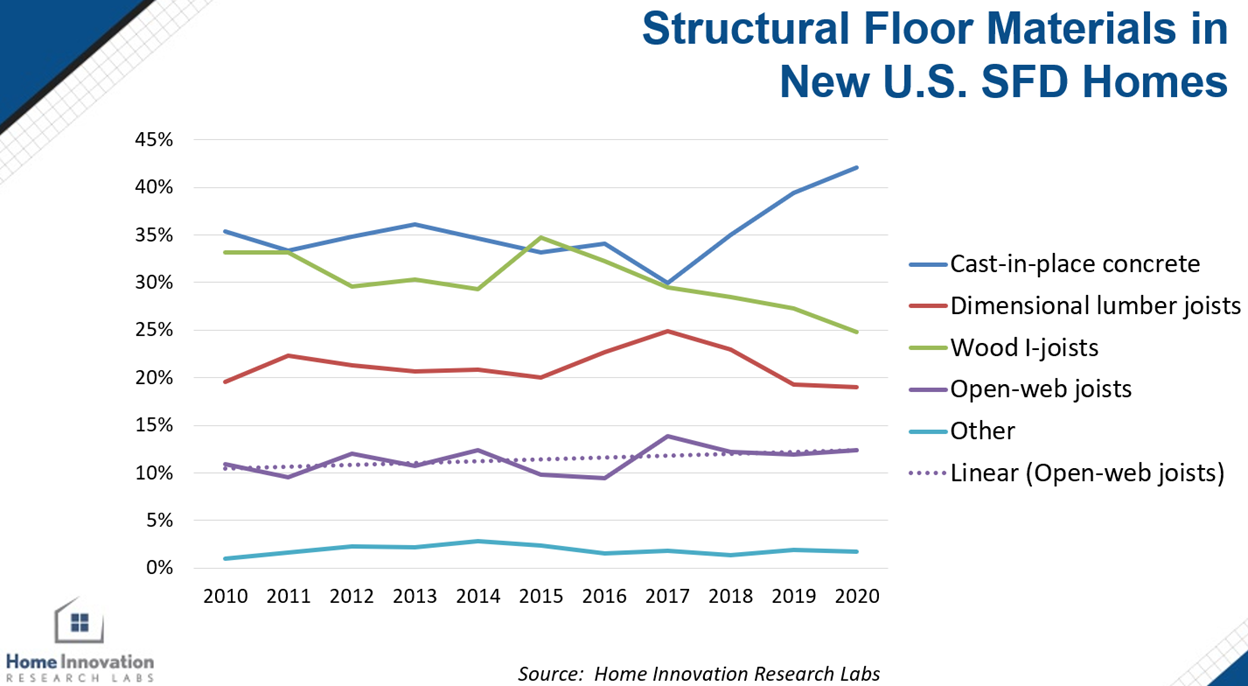

If a picture speaks a thousand words, the chart below neatly summarizes more than ten thousand words regarding building code impacts. Chart’s green line represents wood I-joists, clearly preferred framing product for non-slab-on-grade first floors and floors above grade. Market share was actually increasing until 2015, when most states updated to 2012 versions of model code. In IRC (International Residential Code), Section R501.3 (R 503.1 in later versions of the code), gypsum sheathing was now required on all unprotected wood structural framing unless it was constructed using dimensional lumber.

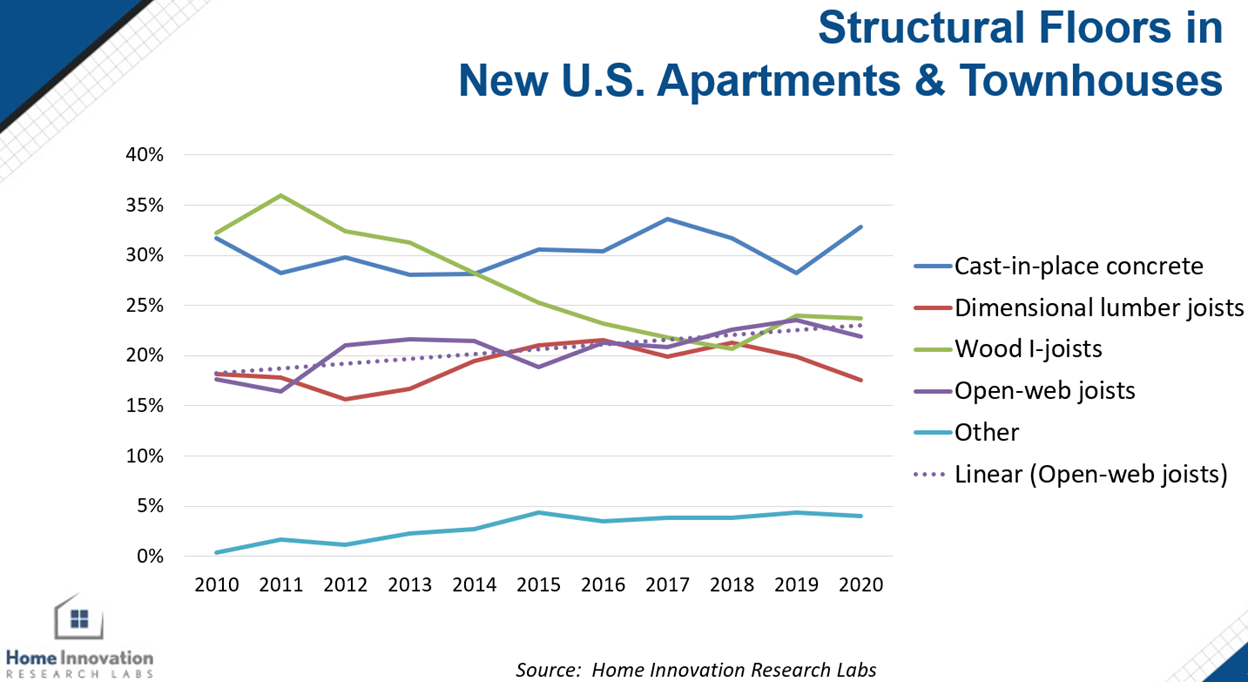

This code change had an immediate impact on builder preference, with I-joists and dimensional lumber market share moving in opposite directions. Curiously, over time this code change may have actually prompted some builders to finish off basements and use open-web floor trusses to more easily run all MEP (mechanical, electrical, plumbing) in the floor cavity. Benefits of easier MEP installation in floor trusses is efficiently illustrated in builder-preference in multi-family construction, where market share has also increased over time, as chart below shows.

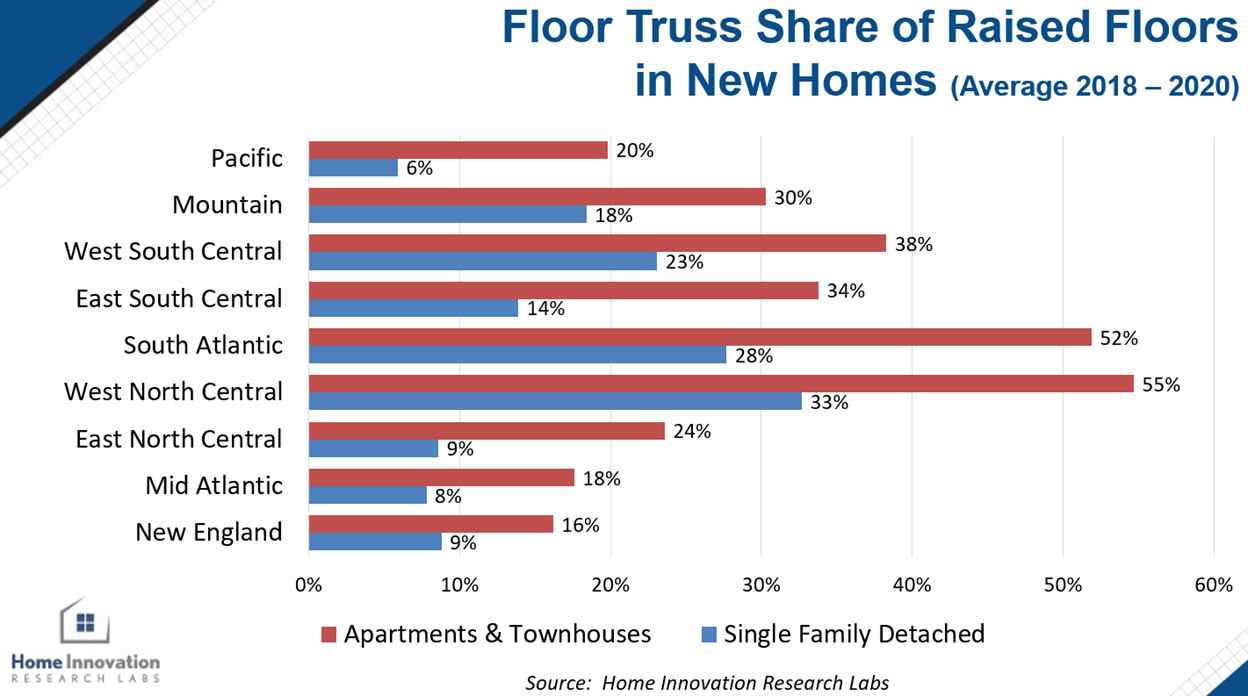

Since 2017, slab-on-grade single-family construction has surged. While this has taken relative market share from both dimensional and EWP joists, open-web floor truss share has continued to increase (albeit, slightly). Given dramatic shifts in market share, this national market resiliency of floor trusses suggests in non-slab markets, floor truss market share has increased in recent years. Chart below shows there is currently significant regional preference for floor trusses.

All of this data suggests there is an opportunity for significant market share growth for floor trusses, given they offer an incredibly efficient and accurate floor framing system utilizing less lumber and easing labor burden for all MEP trades.

Personally, our now 16 year old post frame shouse (shop/house) utilizes floor trusses to give a 48 foot clearspan over our basketball half-court and provides a comfortable structural system for our second floor living space. All of our plumbing, electrical and HVAC is run through our floor truss system, providing an unobstructed ceiling downstairs.

Planning upon a multi-story post frame building? Open-web wood floor trusses might very well be an excellent design solution.