Better Entry-Level Barndominiums

Thanks to John Burns Real Estate Consulting for providing content data.

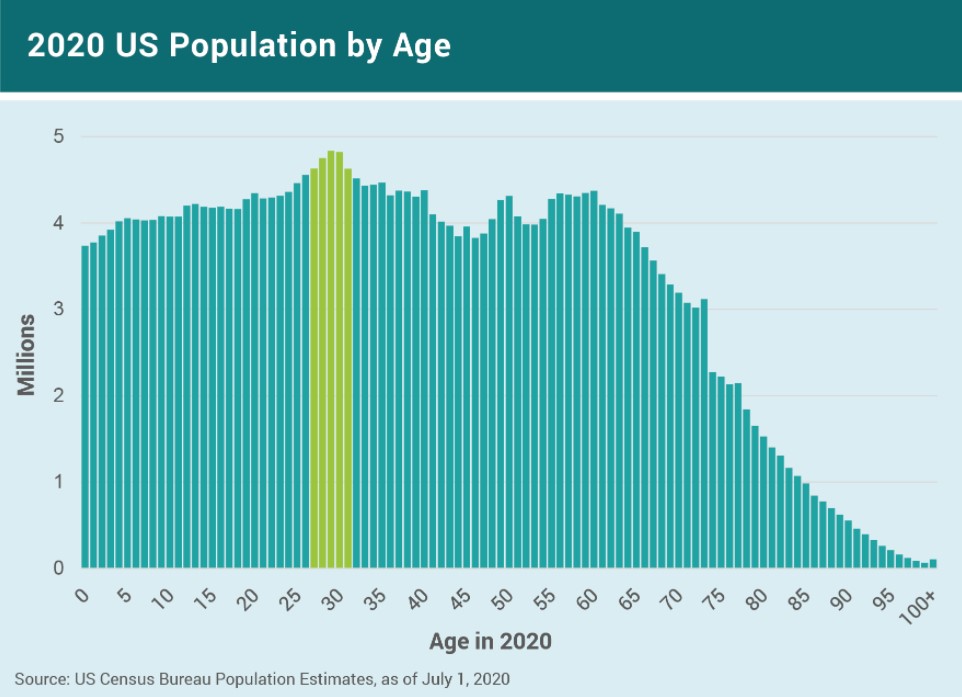

US’s largest age group today is 27 to 31 years old. My three adult children are now 31, 27 and 26, pretty well hitting right in there. With the median age of an entry-level buyer at 33 (according to National Association of Realtors), we believe demographics will continue to support strong home buying demand for the next several years. To attract younger buyers, we highlight our housing, demographic, and consumer research leading to opportunities in marketing and post-frame home design.

Housing: Young Buyers Are Already Here.

Those who focus on entry-level buyers are reporting strongest sales. Younger buyers (<35) are stronger than in past years, and many times are those spending at the upper end in our neighborhoods. As entry-level buyers are a bit older than they have been in past years, they are more likely to be in a better financial situation.

While some younger buyers may be in higher-priced home markets, there is certainly a segment of this cohort looking for affordability. This is becoming more of a challenge in today’s rising-price / low-inventory housing market.

Demographics: Entry Level Home Size May Be a Tradeoff for Affordability.

CDC recently reported births declined in 2020 to the lowest level since 1979. With fewer babies being born, perhaps our future’s home has fewer bedrooms.

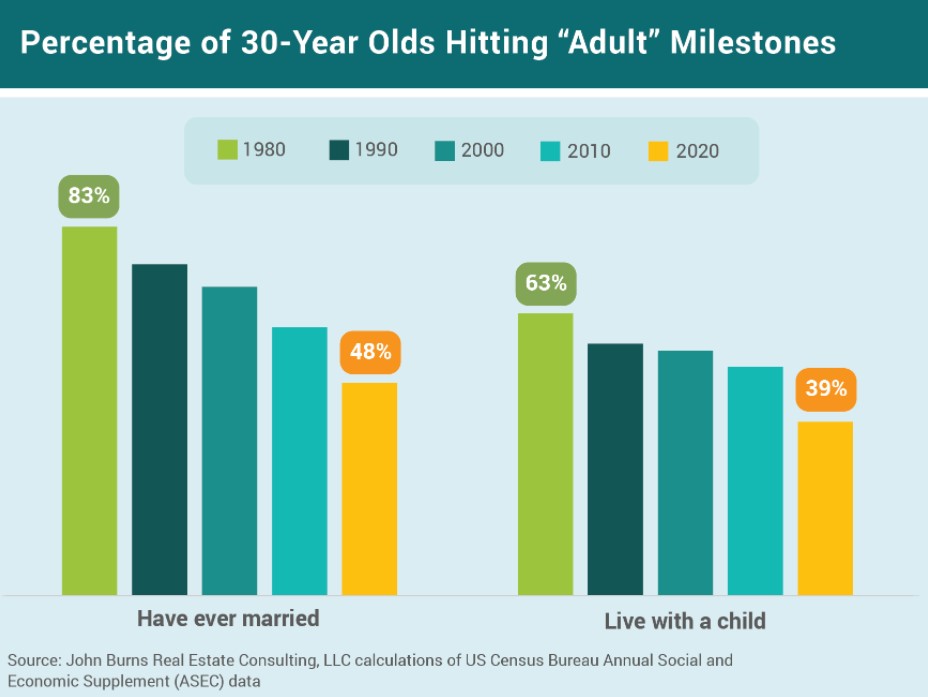

Our Press has made much about delays in “adult” milestones for Millennials. But as this chart for 30-year-olds below shows, this is nothing new— these are decade-long trends. Over time, most young adults will still get married and will still have kids; hitting adult milestones later doesn’t mean never hitting them. Meanwhile trends suggest significant demand in coming years.

Consumer Research: Reframe Messages

This combination of our housing, demographic and consumer research presents a great barndominium marketing and design opportunity: rather than focus on just bedrooms and bathroom count, why not advertise as “3 bedrooms, 2 bathrooms and 2 home offices?”

Even if fewer bedrooms are needed, work-from-home environments emphasize needs for private, flexible spaces, even if they are small. Simply having a spare bedroom where you put your desk does not equal a functional home office or workspace. A niche or a nook tucked off a common area, or a small private space to make phone/video calls can be suitable alternatives to a private office.

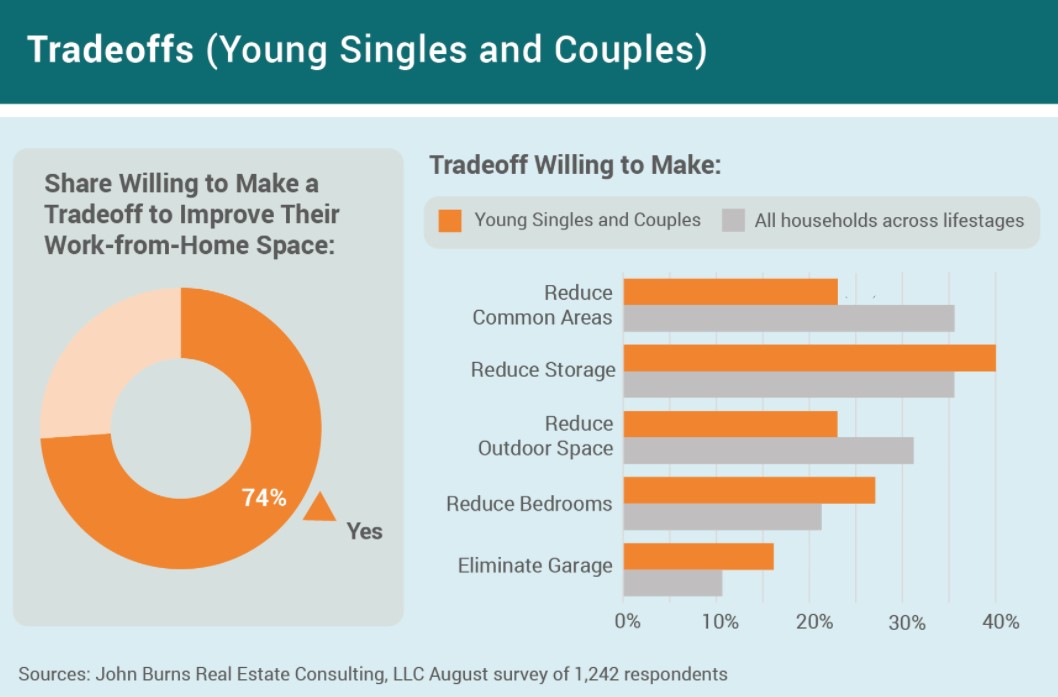

Young singles and couples without kids are most willing to sacrifice storage space—more so than any other life stage group we surveyed—to improve their work-from-home space, perhaps because they have fewer possessions accumulated and are greater adopters of a sharing economy.