Is Western SPF at $2000 Just Around the Corner?

Originally Published by: Russ Taylor Global by Russ Taylor, President — May 4, 2021

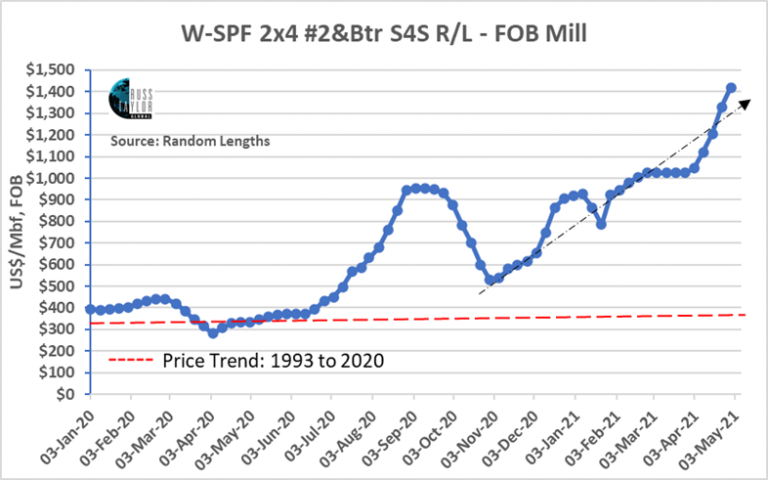

In late July 2020 I wrote an article in the WOOD MARKETS Monthly Report (my last-ever editorial) where I posed the question if W-SPF 2×4 #2&Better Random Lengths (FOB BC Mill) lumber could achieve the US$1,000/Mbf threshold (US$645/m3, net) in the COVID-induced rally that had started. At that time, W-SPF was trading at US$678/Mbf – or just over two-thirds of the way from the $1,000 target. In fact, the rally lasted only another -4-5 weeks into early September before prices peaked at US$955/Mbf. Close, but no cigar.

However, this was not the end of the price cycle – as many, if not most, had expected. Prices of 2×4 bottomed out at $530/Mbf in late October 2020 and then the second price wave started. W-SPF prices rose to $927 on January 8 before slumping for two weeks to $785.

Then the third (and current) wave started where prices have increased every week since (aside from holding steady for five weeks at $1,025) and at the time of this writing (May 1) prices were sitting at $1,420/Mbf (US$917/m3, net). Ironically, this is also just over two-thirds of the way to the next threshold of $2,000 but with extraordinarily strong momentum. Is a $2,000 price ($1,292/m3, net; or ~$1,375/m3 delivered US East Coast) for SPF possible during this cycle? Prices have increased $400/Mbf in the last five weeks (to April 30) – if this sizzling pace (averaging $80/week) were to continue, we would be there in nine weeks, or the end of June! As the graph shows, the recent torrid pace in April is unprecedented, but anything seems to be possible this year.

There are several reasons why this bold outlook has potential!

Supply issues:

- Sawmills are operating full-out and capacity is constrained for any significant increases.

- Acute trucking and container shortages with prices that are 50% to 150% higher than one year ago.

- Scarcity of skilled labour – logging to mills to logistics providers.

- Potential of summer forest fires and mill curtailments through to September are very possible.

- The production and export potential of the BC lumber industry continues to fade due to a myriad of issues. Aside from the fallout from mountain pine beetle epidemic, there are also more damaging government initiatives to the BC fibre supply and industry cost structure that are looming (stumpage formula, transfer of tenures to First Nations, fibre recovery zones and penalties, various and pending export restrictions on logs and cants, caribou protection strategy, AAC reductions, old-growth and parks strategy, environmentalists, other bark beetle infestations, etc.).

- Only the US South has the potential to substantially increase lumber production in North America.

Factors that could improve US lumber supply to ease price pressure include:

- Offset by reduced offshore lumber exports.

- Offset by more lumber imports from Europe and the Southern Hemisphere (as well as Canada).

- Offset by the potential of lower COVID restrictions at mills.

- More substitute products may be considered.

Demand issues:

Factors that could stall US lumber demand and prices:

- Scarce lumber and OSB volumes could delay house construction, increasing available inventories at dealers and causing a slowdown on mill orders

- Shortages of labour for house building could slow lumber demand.

- Housing prices have increased significantly, as have mortgage rates, so affordability issues for first-time buyers will start to limit demand for new and existing homes.

- Lumber and panel costs in the framing package for new US housing construction have increased by anywhere from US$36,000 (NAHB) to $50,000 (Layman’s Lumber Guide) from one year ago. This will continue to increase as current lumber and panel price increases are lagging actual building material costs on jobsites by about two months.

- A slower pace in the building season could kick in during the summer heat.

However, there are many demand factors (housing starts; repair and remodelling) that continue to favour the strong demand cycle and they still outweigh the negative factors, at least for now. If dealers and builders need to purchase inventory at any price – at that about sums it up the current market sentiment – then the lumber price advances will continue for a time. Inevitably, prices will correct, but when and to what level they will drop is what is making buyers extremely nervous.

There is a chance that the average W-SPF 2×4 price could average over US$1,000/Mbf for 2021 – quite unbelievable, except this year! History suggests that whenever expectations get too lofty, things can change for the negative very quickly. If it is too good to be true, then it probably is not. And nothing cures high lumber prices like high lumber prices. Trying to forecast lumber prices in the unprecedented market is impossible – anyone that does can only be lucky if they are close but will most likely be wrong!

There are already spot market transactions of 9-foot studs at over $1,800/Mbf delivered to the US east coast and Texas. Getting to the $2,000/Mbf threshold for some products on a delivered basis is possible and, in fact, highly likely! Whether the W-SPF 2×4 R/L FOB mill price gets there is probably a stretch, but momentum suggests it will get close – just like the first and second cycles!

However, W-SPF 2×4 is currently at a substantial premium to SYP: instead of the normal $70-$80/Mbf discount, SPF is at a whopping $200+/Mbf premium! As this creates a disincentive to buyers of SPF, the question is: will SYP prices catch up or will SPF prices start to peak sooner rather than later? As always, the outcome will be played out in the lumber markets and no one can really predict what is going to happen in this crazy cycle until it happens!